Chronic economic underdevelopment has been a constant feature of Arab societies in modern times. Most recently, unemployment, underemployment, and lack of basic social services have been a major trigger of the Arab Spring uprisings that led to the downfall of several long-standing Arab regimes, the disintegration of nation-states, and two counter-revolutions. As we witness political solutions falter in the face of enduring economic problems, it is clear that economic solutions must go hand-in-hand with political ones. Otherwise, Arab societies are unlikely to emerge from this upheaval in a better place.

With that as a background, I met several times with my friend, Ahmed Moor, to discuss solutions to these regional economic problems. liwwa, founded in November 2012, is the outcome of these meetings. We explored ideas that could develop sustainably while addressing social and economic development. In particular, we focused on the severe lack of access to finance that Arab small and medium enterprises (SMEs) face. In fact, the Middle East and North Africa (MENA) region has the second-largest gap in SME financing in the world – $350 billion annually – coming in only after sub-Saharan Africa.

♦ Only one in six small and medium enterprises in the Arab world have access to some sort of financial loan facility, compared to a global average of one in three. The Arab SME financing gap exceeds $350 billion annually, making it the second most difficult region in the world for business financing.

Readers who have been to an Arab country recently may consider what an average day could be like. One might buy coffee from a street vendor before driving to the local mechanic for an oil change. In the afternoon, a visitor may meet friends for lunch at a well-known neighborhood restaurant. These businesses are the heart of the economy, and they employ the majority of non-public-sector employees – they’re the SMEs we seek to serve.

The importance of SMEs to economies in MENA (and globally as well) is illustrated by the fact that they account for 80 percent of all economic activity in some countries, such as Egypt. They also account for 60 percent or more of all jobs in most economies – including in the United States. Despite this reality, Arab governments, banks, and financial institutions were clearly failing to provide the financial access that regional economies needed. The consequence is chronic unemployment, underemployment, income stagnation and, understandably, frustration and discontent, especially amongst young people.

So SME financing seemed like a natural place for Ahmed and me to start working. We wanted to develop a solution that involved as many people in our communities as we could. And we wanted to do it by leveraging technology and participatory processes. That’s why we founded liwwa, an online lending site that functions through the activity of lots of people. liwwa, by the way, is the colloquial Arabic word for “banner” and for “district.” In a sense, the organization could act as a rallying point, a banner, for a group of people united in a common cause.

Peer-to-Peer Lending

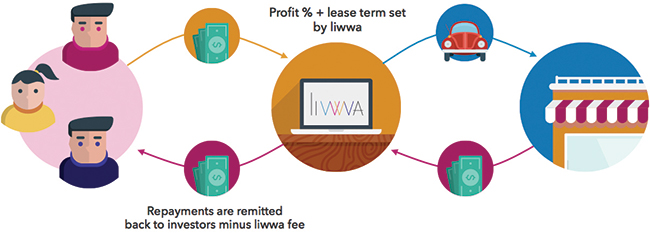

Peer-to-peer (P2P) lending is basically the idea that a group of people can lend money to a business or another individual without having to go through traditional financial intermediaries such as banks or other lending companies. So a loan of $10,000 can be provided by a large group of investors, each contributing amounts as little as $10 or so, in exchange for a proportionate share of the payments

and interest when the loan is being repaid. Furthermore, investors can choose to divide their own money across a wide range of loans.

In a sense, P2P lending is a native concept in the Arab world. More often than not, when people need help starting a new business or growing an existing one, they go to their communities and work to secure the resources they need from friends and family.

liwwa takes the concept of P2P lending and applies it to SME financing in the

Arab world. Our goal is to deliver a valuable service to borrowers who may not have access to loan capital. At the same time, we aim to provide a service to lenders. That’s because there are very few opportunities for an active investor to diversify his or her portfolio in local markets and, when such investment opportunities present themselves, they are often high-risk deals with hard-to-model returns.

liwwa, on the other hand, presents an easy way for investors to diversify their investment portfolio across many companies. For example, an investor may fund his/her account with $1,000 and split that amount among 10 small and medium business loans with different risk ratings. In effect, a liwwa investor can achieve a much greater degree of control over his/her portfolio’s risk ratios than is easily possible for the average investor in the region. Furthermore, investors can use loan repayments to immediately reinvest in other SMEs, compounding both their investment power and their contribution to the local economy.

When Ahmed and I started liwwa a year and half ago, we knew that this was not an easy environment in which to start a business. Like any other small business in the region, we’ve faced regulatory, bureaucratic, and financial challenges that we couldn’t have overcome without the support of many in our local community.

The list of those who have supported us in the past several months is longer than can be recounted here, and it will doubtless grow larger as time goes by. We’ve seen first-hand the struggles a small business faces in our countries, but we have also seen first-hand the powerful resources that businesses can reach out to within our own communities. This has only strengthened our belief in the fundamental mission of liwwa, which is to empower the community to steer itself on the path to economic success. We are optimistic that this drive to build self-reliant models of economic growth will contribute to the success of our nascent political generation in building the free and socially just Arab societies we all strive for.

» Samer Atiani is a Palestinian software engineer and co-founder of liwwa, Inc. After graduating from Ramallah Friends School, he went on to study physics and economics, and then worked for seven years in New York City for such companies as Wireless Generation and Etsy. In his free time, he likes to cook, dance, and play StarCraft and SimCity 3000. He can be reached at samer@liwwa.com.